How Much Can I Write Off On A Rental Property . The nine most common rental property tax deductions are: Tax write off for rental property #1: Rental property owners can deduct the costs of owning, maintaining, and operating the property. Here are five rental property tax deductions that should be on your radar. Most residential rental property is. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Most homeowners use a mortgage to purchase. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Owning a rental property can generate income and some great tax deductions.

from www.personalfinanceclub.com

Most homeowners use a mortgage to purchase. The nine most common rental property tax deductions are: Rental property owners can deduct the costs of owning, maintaining, and operating the property. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Most residential rental property is. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Here are five rental property tax deductions that should be on your radar. Tax write off for rental property #1: Owning a rental property can generate income and some great tax deductions.

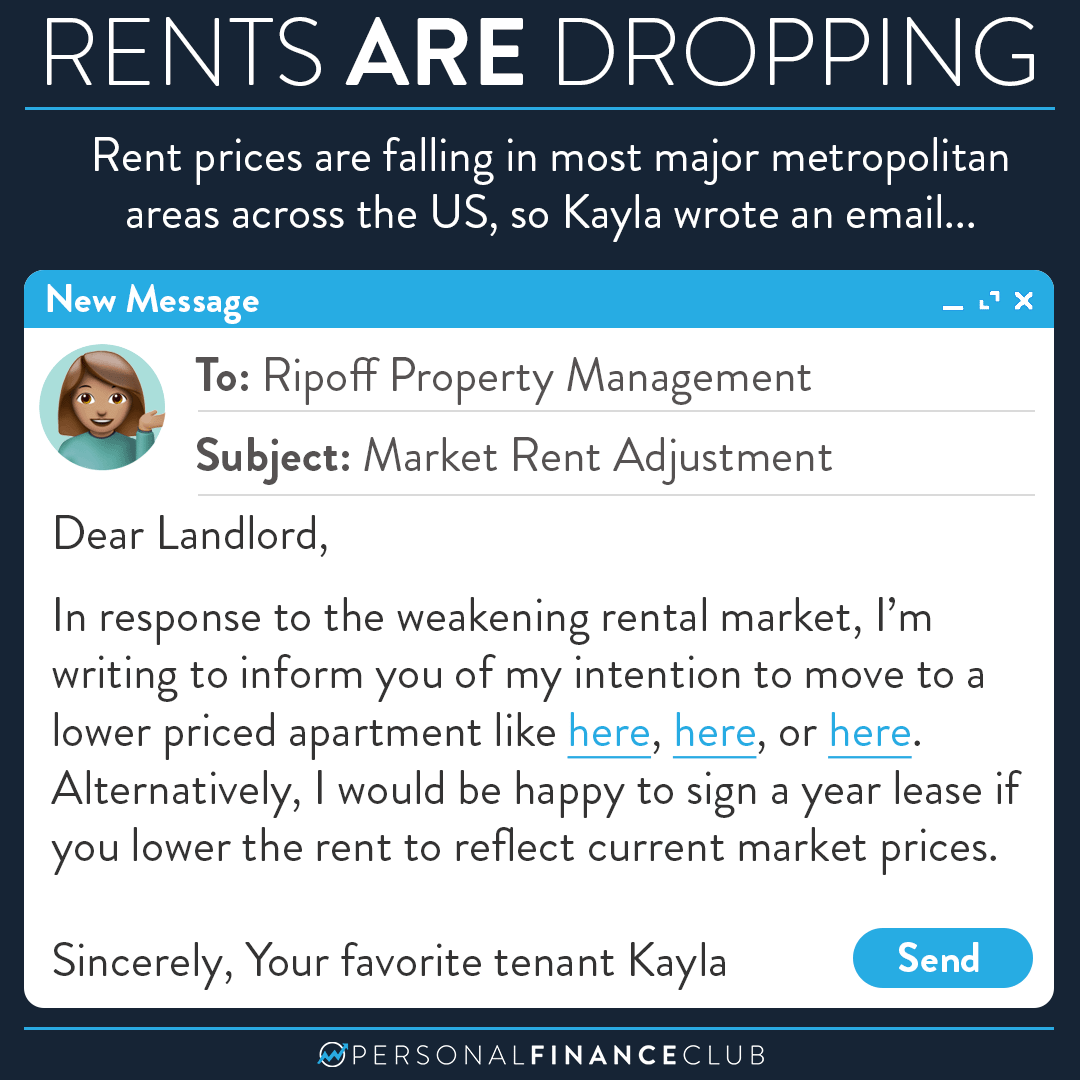

Send Your Landlord a Market Rent Adjustment Email Personal Finance Club

How Much Can I Write Off On A Rental Property Tax write off for rental property #1: Owning a rental property can generate income and some great tax deductions. Most homeowners use a mortgage to purchase. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Tax write off for rental property #1: Most residential rental property is. Here are five rental property tax deductions that should be on your radar. The nine most common rental property tax deductions are:

From www.pinterest.com

Small Business Tax Write Offs Imperfect Concepts Business tax How Much Can I Write Off On A Rental Property Tax write off for rental property #1: Most homeowners use a mortgage to purchase. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Owning a rental property can generate income and some great tax deductions. Real estate by income deduction. How Much Can I Write Off On A Rental Property.

From bestlettertemplate.com

Rent Payment Letter Template Format, Sample & Examples How Much Can I Write Off On A Rental Property Owning a rental property can generate income and some great tax deductions. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Most homeowners use a mortgage to purchase. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real. How Much Can I Write Off On A Rental Property.

From www.getwordtemplates.com

20+ Rental Agreement Templates Word Excel PDF Formats How Much Can I Write Off On A Rental Property Owning a rental property can generate income and some great tax deductions. Most homeowners use a mortgage to purchase. Most residential rental property is. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Here are five rental property tax deductions that should. How Much Can I Write Off On A Rental Property.

From realwealth.com

Should I Pay Off My Rental Property Mortgage? RealWealth How Much Can I Write Off On A Rental Property Here are five rental property tax deductions that should be on your radar. Tax write off for rental property #1: Owning a rental property can generate income and some great tax deductions. The nine most common rental property tax deductions are: Most residential rental property is. Most homeowners use a mortgage to purchase. Real estate by income deduction so, if. How Much Can I Write Off On A Rental Property.

From justdoproperty.co.uk

Can You Write off Rental Property Losses in the Uk? Just Do Property How Much Can I Write Off On A Rental Property Most homeowners use a mortgage to purchase. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Here are five rental property tax deductions that should be on your radar. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. The nine most common rental property tax deductions are: Owning a. How Much Can I Write Off On A Rental Property.

From www.youtube.com

Can I Write Off My Rent As A Business Expense? YouTube How Much Can I Write Off On A Rental Property Most residential rental property is. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Here are five rental property tax deductions that should be on your radar. The. How Much Can I Write Off On A Rental Property.

From sparkrental.com

Make your Free Eviction Notice PDF SparkRental How Much Can I Write Off On A Rental Property Rental property owners can deduct the costs of owning, maintaining, and operating the property. Most homeowners use a mortgage to purchase. Most residential rental property is. Here are five rental property tax deductions that should be on your radar. Owning a rental property can generate income and some great tax deductions. Landlords can deduct most ordinary and necessary expenses related. How Much Can I Write Off On A Rental Property.

From eforms.com

Free Rent Payment Hardship Letter Sample PDF Word eForms How Much Can I Write Off On A Rental Property Rental property owners can deduct the costs of owning, maintaining, and operating the property. Most residential rental property is. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. The nine most common rental property tax deductions are: Tax write off for rental property #1: Here are five rental property tax deductions that should be. How Much Can I Write Off On A Rental Property.

From realwealth.com

Should I Pay Off My Rental Property Mortgage? RealWealth How Much Can I Write Off On A Rental Property Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Most residential rental property is. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Here are five rental property tax deductions that should be on your radar. Tax. How Much Can I Write Off On A Rental Property.

From www.sampletemplates.com

FREE 8+ Sample Rental Reference Letter Templates in PDF MS Word How Much Can I Write Off On A Rental Property The nine most common rental property tax deductions are: Owning a rental property can generate income and some great tax deductions. Tax write off for rental property #1: Rental property owners can deduct the costs of owning, maintaining, and operating the property. Most homeowners use a mortgage to purchase. Real estate by income deduction so, if you are making $100,0000. How Much Can I Write Off On A Rental Property.

From esign.com

Free Commercial Letter of Intent to Lease PDF Word How Much Can I Write Off On A Rental Property Owning a rental property can generate income and some great tax deductions. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Here are five rental property tax deductions that should be on your radar. The nine most common rental property. How Much Can I Write Off On A Rental Property.

From www.pinterest.com

List of Things You Can Write Off on Your Taxes for Rental Property How Much Can I Write Off On A Rental Property Most homeowners use a mortgage to purchase. Owning a rental property can generate income and some great tax deductions. The nine most common rental property tax deductions are: Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Rental property owners can deduct. How Much Can I Write Off On A Rental Property.

From www.youtube.com

How to write off rent YouTube How Much Can I Write Off On A Rental Property Rental property owners can deduct the costs of owning, maintaining, and operating the property. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Most residential rental property is. The nine most common rental property tax deductions are: Most homeowners use a mortgage to purchase. Tax write off for rental property #1: Here are five. How Much Can I Write Off On A Rental Property.

From paulaycristinaeventos.blogspot.com

How To Write A Rent Receipt paulaycristinaeventos How Much Can I Write Off On A Rental Property The nine most common rental property tax deductions are: Most residential rental property is. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Landlords can deduct most ordinary. How Much Can I Write Off On A Rental Property.

From help.taxreliefcenter.org

How To Write Off Taxes On Rental Property Tax Relief Center How Much Can I Write Off On A Rental Property Tax write off for rental property #1: Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real estate. Here are five rental property tax deductions that should be on your radar. Most residential rental property is. Landlords can deduct most ordinary and necessary expenses. How Much Can I Write Off On A Rental Property.

From www.youtube.com

How To Write Off Rental Property Depreciation YouTube How Much Can I Write Off On A Rental Property Owning a rental property can generate income and some great tax deductions. Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Most homeowners use a mortgage to purchase. Here are five rental property tax deductions that should be on your. How Much Can I Write Off On A Rental Property.

From www.youtube.com

CPA Answers Can you write off rent? YouTube How Much Can I Write Off On A Rental Property Owning a rental property can generate income and some great tax deductions. Most residential rental property is. Most homeowners use a mortgage to purchase. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Here are five rental property tax deductions that should be on your radar. Landlords can deduct most ordinary and necessary expenses related. How Much Can I Write Off On A Rental Property.

From andersonadvisors.com

Learn How to Write Off Rental Property Expenses in this episode How Much Can I Write Off On A Rental Property Here are five rental property tax deductions that should be on your radar. Rental property owners can deduct the costs of owning, maintaining, and operating the property. Owning a rental property can generate income and some great tax deductions. The nine most common rental property tax deductions are: Landlords can deduct most ordinary and necessary expenses related to the renting. How Much Can I Write Off On A Rental Property.